Криптовалюта для новичков в 2025: инструкция для начинающих

13/03/2024Natural Language Understanding with Sequence to Sequence Models by Michel Kana, Ph D

21/03/2024

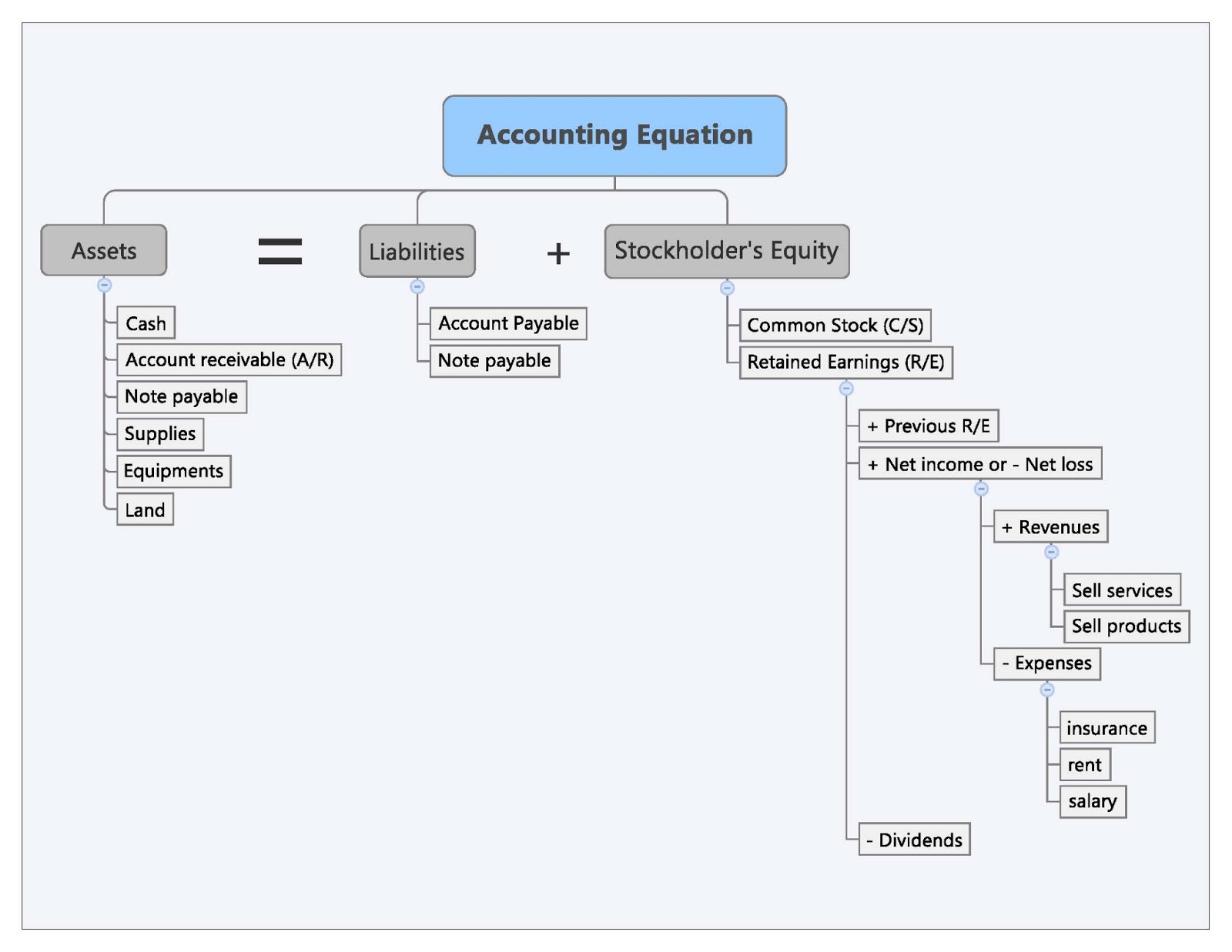

As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved. The accounting equation’s left side represents everything a business has (assets), and the right side shows what a business owes to creditors and owners (liabilities and equity). At the same time, it incurred in an obligation to pay the bank. The fundamental accounting equation, as mentioned earlier, states that total assets are equal to the sum of the total liabilities and total shareholders equity. This equation holds true for all business activities and transactions.

Arrangement #3: Assets = Liabilities + Owner’s Capital – Owner’s Drawings + Revenues – Expenses

In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings. This then allows them to predict future profit trends and adjust business practices accordingly. Thus, the accounting equation is an essential step in determining company profitability. The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system.

- The accounting equation is a vital concept in accounting, underpinning financial reporting and analysis.

- On the other hand, equity refers to shareholder’s or owner’s equity, which is how much the shareholder or owner has staked into the company.

- Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

- Just like with our current assets and long term assets, we have the same threshold of 1 year.

What if any one of these elements changes?

Earnings give rise to increases in retained earnings, while dividends (and losses) cause decreases. If a company keeps accurate records using the double-entry system, the accounting equation will always be “in balance,” meaning the left side of the equation will be equal to the right side. The balance is maintained because every business transaction affects at least two of a company’s accounts. For what is the indexation definition example, when a company borrows money from a bank, the company’s assets will increase and its liabilities will increase by the same amount. When a company purchases inventory for cash, one asset will increase and one asset will decrease. Because there are two or more accounts affected by every transaction, the accounting system is referred to as the double-entry accounting or bookkeeping system.

Everything You Need To Master Financial Modeling

The following illustration for Edelweiss Corporation shows a variety of assets that are reported at a total of $895,000. Creditors are owed $175,000, leaving $720,000 of stockholders’ equity. The purpose of this article is to consider the fundamentals of the accounting equation and to demonstrate how it works when applied to various transactions. The balance sheet is also known as the statement of financial position and it reflects the accounting equation. The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time.

Eric is an accounting and bookkeeping expert for Fit Small Business. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. A T-account is a visual representation of the general ledger, whereas the general ledger is an accounting record that shows more detailed information than a T-account. Accountants and bookkeepers use the T-account to analyze transactions and spot errors easily without going through detailed ledger information.

Why must Accounting Equation always Balance?

Merely placing an order for goods is not a recordable transaction because no exchange has taken place. In the coming sections, you will learn more about the different kinds of financial statements accountants generate for businesses. Current assets are resources that a company expects to convert into cash or use up within one year. Examples include cash, accounts receivable, and inventory.

To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation. Refer to the chart of accounts illustrated in the previous section. Taking time to learn the accounting equation and to recognise the dual aspect of every transaction will help you to understand the fundamentals of accounting. Whatever happens, the transaction will always result in the accounting equation balancing. Anushka will record revenue (income) of $400 for the sale made. A trade receivable (asset) will be recorded to represent Anushka’s right to receive $400 of cash from the customer in the future.

On 2 January, Mr. Sam purchases a building for $50,000 for use in the business. The impact of this transaction is a decrease in an asset (i.e., cash) and an addition of another asset (i.e., building). The rights or claims to the properties are referred to as equities. Incorrect classification of an expense does not affect the accounting equation. The 500 year-old accounting system where every transaction is recorded into at least two accounts. An asset is a resource that is owned or controlled by the company to be used for future benefits.

Long-term assets, on the other hand, are resources that a company expects to use for more than one year. The distinction between current and long-term assets is important for understanding a company’s liquidity and long-term financial health. Before explaining what this means and why the accounting equation should always balance, let’s review the meaning of the terms assets, liabilities, and owners’ equity.